Summary of Advance Management Accounting

KIESO, WEIGANDT & WARFIELD – ACCOUNTING

Accounting is a process of identify, authorise, measure, recognise, clarify, consolidate, summarise and present the financial date from economic transaction or event of an organisation to give relevant information to users for making decision.

The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity. SFAC no 8.

Accounting is the body knowledge and functions concerned with systematic originating, authenticating, recording, classifying, processing, summarising, analysing, interpreting, and supplying dependable and significant information covering transactions and events which are, in part at least, of a financial character, required for the management and operation of an entity and for reports to be submitted thereon to meet fiduciary and other responsibilities.

Accounting theory is basic assumptions, definition, principle, and concept and explain how to use the account rules made by legislator, to report accounting and financial accounting.

Accounting principle is all ideologies, ideas, assumptions, concepts, postulates, procedures, methods, and accounting techniques that available both in theory and practice, and use as knowledge.

Accounting standard is concepts, principles, techniques that deliberately chosen as a conceptual basis, by a regulatory standards, which implemented on the official document in order to achieve the objective of financial reporting.

Process of Making Standard

- Basic Assumption: periodicity, going concern, monetary unit, business entity, accrual basis

- Conceptual framework: SFAC 1-8

- Principles: revenue recognition, expense recognition, measurement, full disclosure

- Standard: IAS, SFAS,

- Interpretation

Accounting Cycles:

- Journalising. general journal and special journal.

- Posting to ledger

- Trial Balance

- Adjusting entries: Deferrals (prepaid expense & unearned revenues) and Accruals (accrued revenues & accrued expenses)

- Adjusted Trial Balance

- Financial Statements

- Closing Entries – Posting Closing Entries to ledgers

- Post Closing Trial Balances

- Reversing Entries

*Notes

- Prepaid expenses: supplies, insurance, depreciation

- Unearned revenues: rent, magazine, subscriptions and customer deposit

Componets of Financial Statements

- Statement of Financial Position : Non current assets, Current Assets, Equity, Non Current Liabilities, Current Liabilities.

- Statement of Income : Gross Profit, Income from Operations, Income before Income Tax, Net Income, Allocation to Non-Controlling Interest, Earnings per Share, Discontinued Operations, Intraperiod Tax Allocation,

- Statement Cash Flow : Cash Flow from Operating Activities, Investing Activities, Financing Activities

- Statement of Changes in Equity

Definition of Financial Reporting Why General Purpose

………………………………….

Framework for Financial Reporting

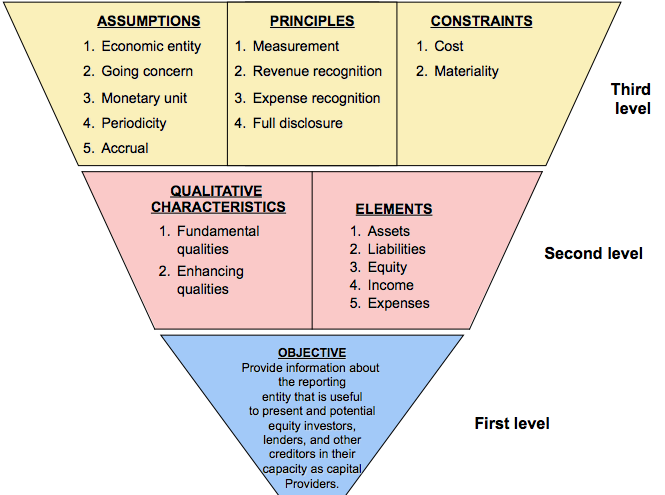

1st Level – Objective of Financial Reporting

Provide financial information about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors in making decisions in their capacity as capital providers.

2nd Level – Fundamental Concepts: Qualitative Characteristics of Accounting Information

Distinguish better (more useful) information from inferior (less useful) information for decision making purposes

- Relevance : Accounting information must be capable in making difference in a decision. Financial information has predictive value (ingredients of the fundamental quality) if it has value as an input to predictive processes used by investors to form their own expectations about future. In addition, it has confirmatory value if it helps to confirm or correct users’ past prediction about that ability.

- Faithful Representation means that the numbers and descriptions match what really existed or happened. Ingredients of the fundamental quality are completeness, neutrality, and free from error. Completeness means that all information that is necessary for faithful representation is provided. Neutrality means that a company cannot select information to favour one set of interested parties over another. Free from error means an information item will be more accurate (faithful) representation of a financial item.

Enhancing Qualities

- Comparability: Information that is measured and reported in a similar manner for different companies.

- Verifiability: Independent measurers, using the same methods, obtain similar results.

- Timeliness: Having information available to decision makers before it loses its capacity to influence decision.

- Understandability: Quality of information that lets reasonably informed users see its significance. It is enhanced when information is classified, characterised and presented clearly and concisely.

Basic Elements – IFRS

- Assets: A resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.

- Liability: A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

- Equity: The residual interest in the assets of the entity after deducting all its liabilities

- Income: Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants.

- Expenses: Decreases in economic benefit during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants.

Basic Elements – SFAC 6

- Assets are probable future economic benefits obtained or controlled by a particular entity as a results of past transactions or events.

- Liabilities are probable future sacrifices of economic benefits arising from present obligation of a particular entity to transfer assets or provide services to other entities in the future as a result of past transaction or event.

- Equity is residual interest in the assets of an entity that remains after deducting its liabilities.

- Investment by owners are increases in equity of a particular business enterprise resulting from transfer to it from other entities of something valuable to obtain or increase ownership interest in it.

- Distribution to owners are decreases in equity

- Comprehensive income is the change in equity

- Revenue are inflows or other enhancements if assets

- Expenses are outflows or other depletions of assets or incurrences of liabilities (or a combination of both) from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations.

- Gains are increase in equity from peripheral or incidental transaction

- Losses are decreases in equity from peripheral or incidental transaction

3rd Level – Recognition, Measurement, and Disclosure Concepts

Basic Assumptions

- Economic Entity means that economic activity can be identified with a particular unit of accountability.

- Going Concern means company have a long live. Depreciation and amortisation policies are justifiable and appropriate only if we assume some permanence to the company. Only where liquidation appears imminent is the assumption inapplicable.

- Monetary Unit means that money is common denominator of economic activity and provides an appropriate basis for accounting measurement and analysis. The monetary unit is relevant, simple, universally available, understandable, and useful.

- Periodicity implies that a company can divide its economic activities into artificial time periods. This phenomenon provides an interesting example of the trade off between relevance and faithful representation in preparing financial data.

- Accrual Basis accounting means that transactions that change a company’s financial statements are recorded in the periods in which the event occur.

Basic Principles of Accounting

- Measurement: cost principle (IFRS Requires that companies account for and report many assets and liabilities on the basis of acquisition price) vs fair value principle (the amount for which an asset could be exchanged, a liability settled, or an equity instrument granted could be exchanged, between knowledgable, willing parties in an arm’s length transaction.

- Revenue recognition: indicates that revenue is to be recognised when it is probable that future economic benefits will flow to the company and reliable measurement of the amount of revenue is possible. Recognition can be done during production, end of production, time of sale (provides a uniform and reasonable test), time cash received.

- Expense recognition: (follow the definition) let the expense follow the revenues. Some companies recognises expense not when they pay wages or make a product, but when the work (service) or the product actually contributes to revenue. Sometimes, cost are allocated to expense (depreciation expense). Different between expense and cost. Cost is

- Full disclosure: it recognises that the nature and amount of information included in financial reports reflects a series of judgemental trade-offs. These tradeoffs strive for (1) sufficient detail to disclose matters that make difference to users (2) sufficient condensation to make the information understandable, keeping in mind costs of preparing and using it. It includes notes to financial statements and supplementary information that present the detail of financial information.

Constraint

- Costs constraint: they must weigh the costs of providing the information against the benefits that can be derived from using it.

- Materiality constraint: concern an item’s impact on a company’s overall financial operations. An item is material if its inclusion or omission would influence or change the judgement of reasonable person.

…………………………………….

Deductive vs Inductive – Prof Suwardjono

- Deductive reasoning is the process of concluding from generally accepted statement (premise) to specific statement as the conclusion. “proses penyimpulan yang brawl dari suatu pernyataan umum yang disepakati (disebut premis) ke peryantaan khusus sebagai simpulan (konklusi).

- Inductive reasoning is the process of concluding from specific statement end with generalisation from the specific conditions. “penalaran ini brawl dari suatu pernyataan atau keadaan yang khusus dan berakhir dengan pernyataan umum yang merupakan generalises (perampatan) dari keadaan khusus tersebut”. Konklusi hanya dapat dijamin dengan confidence level atau coefficient.

Deductive vs Inductive – Wolk, Dodd

- Deductive is

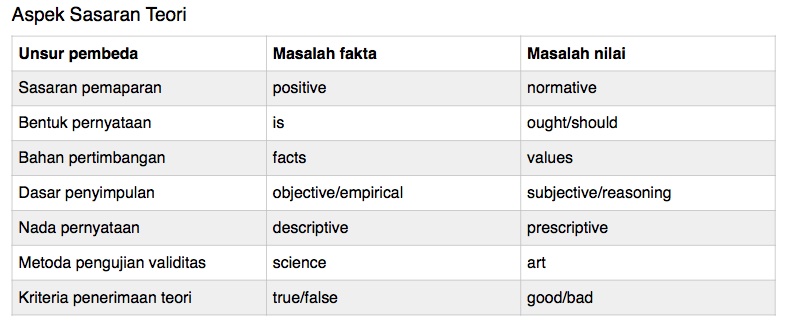

Positive (descriptive) vs Normative

- Penjelasan positif berisi pernyataan tentant sesuatu (kejadian, tindakan, atau perbuatan) seperti apa adanya sesuai dengan fakta atau apa yan terjadi atas dasar pengamatan empiris. Penjelasan positif diarahkan untuk memberi jawaban apakah sesuatu pertanyaan itu benar atau salah (true or false) atas dasar criteria ilmiah.

- Penjelasan normatif berisi pernyataan dan penalaran untuk menilai kebijakan ekonomik atau sosial tertentu. Penjelasan normative diarahkan untuk mendukung atau menghasilkan kebijakan politik sehingga bersifat pembuatan kebijakan (policy making).

3 Tataran Level Semiotika

- Sintatika menelaah logika dan kaidah bahasa yaitu hubungab logis di antara tanda – tanda atau simbol – simbol bahasa.

- Semantika menelaah hubungn antara tanda atau simbol dan dunia kenyataan (fakta) yang disimbolkannya.

- Pragmatika membahas dan menguji apakah komunikasi efektif dengan mempelajari ada tidaknya perubahan perilaku penerima.

Informasi dikatakan mempunyai nilai jika

- Menambah pengethauan pembuat keputusan tentang keputusannya di masa lalu, sekarang, dan masa datanf

- Menambah keyakinan para pemakai

- Mengubah keputusan dan perilaku pemakai

Extraordinary items Discontinued operations Laba akuntansi vs laba ekonomik Extraordinary items

Principle based vs Rules based

Complex Event vs Simple Events

Accruals Basis vs Cash Basis

Fair Value vs Historical Costs

Conservatism

All inclusive income vs current income

General Price Level A

Consolidation

Pooling of interest

Purchase method

Recognition is the process of formally recording or incorporating an item in the financial statements of an entity.

Realization in the most precise sense means the process of converting noncash resources and rights into money and is most precisely used in accounting and financial reporting to refer to sales of assets for cash or claims to cash.

Fundamental Recognition Criteria – SFAC no 5 – Prof Suwardjono

- Definitions (suatu pos harus memenuhi definisi elemen statement keuangan)

- Measurement (suatu pos harus mempunyai attribute yang berpaut dengan keputusan dan dapat diukur dengan tingkat keterandalan yang cukup)

- Relevance (informasi yang dikandung suatu pos mempunyai daya untuk membuat perbedaan dalam keputusan pemakai)

- Reliability (informasi yang dikandung suatu pos secara tepat menyimbolkan fenomena, teruji, terverifikasi dan netral.

Measurement attributes – SFAC no 5 – Prof Suwardjono

- Historical cost or proceeds (kos historis atau perolehan kas historis). Ex. Property, plant, and equipment and most inventories are re- ported at their historical cost, which is the amount of cash, or its equivalent, paid to acquire an asset, commonly adjusted after acquisition for amortiza- tion or other allocations.

- Current cost – replacement cost – entry value (kos semarang). Ex. Some inventories are reported at their current (replacement) cost, which is the amount of cash, or its equivalent, that would have to be paid if the same or an equivalent asset were acquired currently.

- Current market value – exit value (nilai pasar sekarang). Ex. Some investments in mar- ketable securities are reported at their current mar- ket value, which is the amount of cash, or its equivalent, that could be obtained by selling an as- set in orderly liquidation.

- Net realisable value/settlement value – selling cost less any cost to complete or dispose (nilai terealisasi/pelunasan neto). Ex. Short-term re- ceivables and some inventories are reported at their net realizable value, which is the nondis- counted amount of cash, or its equivalent, into which an asset is expected to be converted in due course of business less direct costs, if any, neces- sary to make that conversion.

- Present or discounted value of future cash flows (nilai sekarang atau diskunan-aliran kas masa datang). Long-term receivables are reported at their present value (discounted at the implicit or histori- cal rate), which is the present or discounted value of future cash inflows into which an asset is ex- pected to be converted in due course of business less present values of cash outflows necessary to obtain those inflows.

Statement of Financial Accounting Concept

- Objective of financial reporting by business enterprises

- Qualitative characteristics of accounting information

- Elements of financial statements by business enterprises

- Objective of financial reporting by non-business organisations

- Recognition and measurement in financial statement of business enterprises

- Elements of financial statements

- Using cash flow information and present value in accounting measurement

- Conceptual framework for financial reporting

Current cost vs General Price Level Index Purchasing power gains and losses vs Holding gains and losses Fair value level

- First level

- Second level

- Third level

In use vs in exchange 3 types of in use vs in exchange price Other Comprehensive Income Step to get Comprehensive Income Conservatism Depreciation Impairment Amortization Acretion Apprecation Operational lease Capital Lease Expense vs Cost: Accountants use the term expense to mean a cost that has being used up while a company is doing its main revenue-generating activities.

BOYNTON & JOHNSON – AUDITING

Auditing is a systematic process of objectively obtaining and evaluating evidence regarding the assertions about the economic actions and events to ascertain regarding the degree of corresponds between those assertions and established criteria and communicating the result to the interested users.

Financial Statement audit involves obtaining and evaluating evidence about an entity’s presentation of its financial position, results of operations and cash flows for the purpose of expressing opinion on whether they are presented fairly in conformity with established criteria – usually GAAP.

A compliance audit involves obtaining and evaluating evidence to determine whether certain financial or operating activities of an entity conform to specified conditions, rules or regulations.

Operational audit involves obtaining and evaluating evidence about the efficiency and effectiveness of an entity’s operating activities in relation to specified objectives.

Materiality is the magnitude of an omission or misstatement of accounting information that, in the light of surrounding circumstance, makes it probable that the judgement of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement.

Account balance materiality vs material account balance. Account balance materiality is the minimum misstatement that can exist in an account balance for it to be considered materially misstated. Misstatement up to this level is known as tolerable misstatement. Material account balance refers to the size of a recorded account balance, whereas the concept of materiality pertains to the amount of misstatement that could affect a user’s decision.

Audit risks is the risk that the auditor may unknowingly fail to appropriately modify his or her opinion on financial statements that are materially misstated. Audit Risk is set to be low at first. (AR= IR x CR x DR) . (AR= IR x CR x AP x TD).

Audit evidence is all information used by the auditor in arriving at the conclusion on which the audit opinion is based. It includes (1) the accounting records underlying the financial statements and (2) other information corroborates the accounting records and supports the auditor’s logical reasoning about fair presentation in the financial statements.

Accounting records generally include all records of initial entries and supporting records.

- Check and records of electronic funds transfer

- Invoices

- Contracts

- The general and subsidiary ledger

- Journal entries and other adjustment

Four Decision about audit procedures

- Staffing and supervising the audit

- Nature of audit procedures

- Timing of audit procedures

- Extent of audit procedures

Documenting Audit decisions and audit evidence

- Audit programs

- Working papers

- Preparing working papers

- Working papers files

Generally Accepted Auditing Standards

- Adequate technical training and proficiency

- Independence in mental attitude

- Due professional care

- Adequate planning and proper supervision

- Understanding the entity and its environment, including internal control

- Sufficient competent audit evidence

- Financial statements presented in accordance with GAAP

- Consistency in the application of GAAP

- Adequacy of informative disclosures

- Expression of opinion

Assurance provided by the audit.

Overview of the Audit Process

- Identify Relevant Financial Statement Assertions – Understand the Entity and Its Environment

- Make Decision about Materiality

- Perform Preliminary Analytical Procedures

- Identify the Risks that May Lead to Material Misstatement, including the risk of Fraud

- Develop Preliminary Audit Strategies

- Understand Internal Control

- Assess the risk of material misstatement by determining: relate risk, the potential magnitude, the likelihood.

- Determine responses to assessed risks: audit staffing, nature of audit tests, timing of audit tests, extent of audit tests

- Additional risk assessment procedure – Test of controls – Substantive Tests

- Evaluate audit evidence obtained

- Communication to financial statement users – other required communication to Audit Committee – Communicate Other Assurance Service Findings

Potential Choices of Audit Procedures

- Inspection of Documents and Records – Vouching and Tracing (ST) using sampling

- Inspection of tangible assets – (ST)

- Observation – IC – does not use sampling

- Inquiry – IC – does not use sampling

- Confirmation – ST

- Recalculation – ST

- Reperformance – IC

- Analytical procedures – ST

- Computer-Assisted Audit Techniques (CAATs) – (IC)

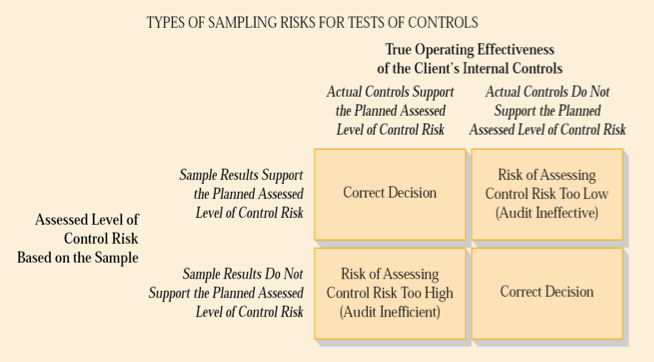

Sampling Risk

- Sampling risk relates to the possibility that a properly drawn sample may not be representative of the population.

- Test of controls

- The risk of assessing control risk is too low

- The risk of assessing control risk is too high

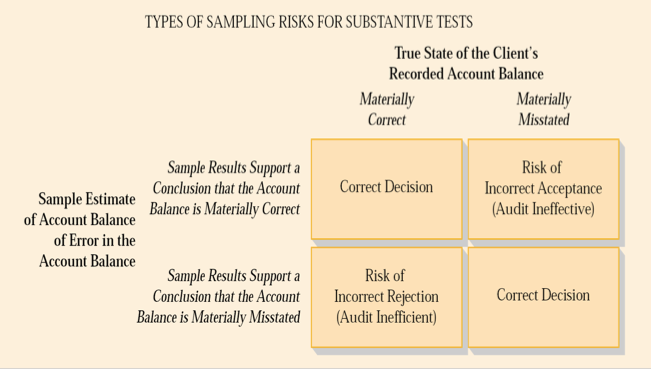

- Substantive tests

- Risk of incorrect acceptance

- Risk of incorrect rejection

- Test of controls

- Non sampling risk refers to the portion of audit risk that is not due to examining only a portion of the data.

Statistical Sampling

- Non statistical sampling. the auditor determines sample size and evaluates sample results entirely on the basis of subjective criteria and his or her experience.

- Statistical sampling. the auditor determines sample size and evaluates sample results using the laws of probability.

Beta and Alpha Risks: Assessing Sampling Risk

IIA Standards state that auditors should use their professional judgement in assessing sampling risk. The two main aspects of sampling risk in compliance tests of internal controls are:

- The risk of over reliance on controls, which is the risk that the sample leads an auditor to place reliance on the control when it is not justified (beta risk); and

- The risk of under reliance on controls, which is the risk that the sample leads the auditor to wrongly evaluate the population as falling beyond tolerance levels (alpha risk)

The auditor should also be concerned with sampling risk when performing substantive tests. Here the risks are classified as follows:

- The risk of incorrect acceptance (beta risk) is the risk that the sample supports the auditor conclusion that the amount or quantity is no materially misstated when in fact it is.

- The risk of incorrect rejection (alpha risk) is the risk that the sample leads the auditor to believe that the amount or quantity is materially misstated when in fact it is not.

Alpha characteristics of the population relate to the efficiency of the audit, while beta risks related to the effectiveness of the audit in the detection of material errors.

Types of Sampling Risks for Tests of Controls

Economic Benefit of Auditing

The Need for Financial Statement Audit – Why the Financial Statement should be Audited

- Complexity

- Remoteness

- Conflict of Interest

- Consequences

Audit Limitation

Types of Audit Opinion. Circumstances : financial statements conform to GAAP, audit completed in accordance with GAAS.

- Unqualified Opinion. Circumstances requiring explanatory power does not exist

- Unqualified Opinion with explanatory paragraph. Circumstances requiring explanatory language exist (e.g., accounting change or going concern.

- Qualified Opinion. Financial statements contain a departure from GAAP> and Auditor unable to obtain sufficient competent evidence (scope limitation)

- Adverse. Financial statements contain a departure from GAAP>.

- Disclaimer. Auditor unable to obtain sufficient competent evidence (scope limitation)

Departures from Standard Report

- Significant deficiency

- A material weakness

Subsequent Events Types:

- Subsequent Event Type 1

- Subsequent Event Type 2

Confirmation Types

- Negative Confirmation

- Positive Confirmation

- Blank Confirmation

Factor that influence planning materiality decision

- Primary Factors

- Secondary Factors

Independency

- Independence in fact can be defined as acting within integrity and objectivity. About being unbiased and impartial when performing attest services

- Independence in appearance addresses the number of potential conflicts of interest that can be observed.

Rules of conduct

- Responsibilities

- The public interest

- Integrity

- Objectivity and independence

- Due care

- Scope and nature of service

Types of documents and records

Vouching vs Tracing

Lapping vs Kitting

Representation Letter

Stock opname = stock taking : calculating the inventories in the factory

Auditing Cycles

- Expenditure Cycles

- Personnel Services Cycle

- Production Cycle

- Revenue Cycle

Auditing the Production Cycle

- Audit objectives

- Understanding the entity and its environment

- Analytical procedures

- Inherent Risks

- Consideration of Internal Control

- Preliminary Audit Strategies

- Possible Substantive test of Inventory Assertions

Consideration of Internal Control

- Common document and records

- Function and related controls

- Initiating production – Planning and Controlling Production

- Produce inventories > issuing raw materials, processing goods in production, transferring completed work to finished goods – protecting inventories

- Recording manufacturing and inventory transaction > determining and recording manufacturing costs, maintaining correctness of inventory balances, management controls

- Additional inventory controls

Possible Substantive Tests of Inventory Assertions

- Initial procedures

- Analytical procedures

- Test of details transaction > Test entries to inventory accounts – Test cutoff of purchases, manufacturing and sales transactions

- Test of details balances > Observation of the client’s physical inventory count – Timing and Extent of the Test – Inventory – Taking Plans – Performing the test – Inventories determined by statistical sampling – Observation of beginning inventories – Test clerical accuracy of Inventory Listings – Test Inventory Pricing – Test cost of Manufactured Inventories – Confirm Inventories at Locations Outside the Entity.

GOVINDARAJAN – MANAGEMENT CONTROL SYSTEM

Management Control System is a system use by management in influencing the organisation members in order to perform entity’s strategy effectively and efficiently for the sake of achieving entity’s objectives.

Goals is general statements of mileposts you need to meet to achieve your vision.

Objectives specific, time-sensitive statements for achieving your goals

Vision is big picture idea of what you want to achieve.

Mission is general statement of how you will achieve your vision.

Core values is how you will behave during the process.

Efficiency is the ratio of outputs to inputs (or the amount of output per unit of input) that is usually measured using profitability and economic value added.

Effectiveness is determined by the relationship between responsibility centre’s output and its objectives.

A responsibility centre is an organisation unit that is headed by a manager who is responsible for its activities.

Corporate level strategy

- Single industry firms

- Unrelated diversified firms

- Related diversified firms

Business unit competitive advantage – Porter’s five forces model

- New entrants

- Suppliers

- Customers

- Substitutes

- Industry competitors

Management Control Activities:

- Planning

- Coordinating

- Communicating

- Evaluating

- Deciding

- Influencing

Formal Control Process:

- Strategic Planning

- Budgeting Preparation

- Responsibility centre performance – Corrective action – Measurement

- Report actual versus plan – Measurement

- Evaluation of Performance – was performance satisfactory

Strategic Planning is the process of deciding on the programs that the organisation will undertake and on the approximate amount of resources that will be allocated to each program over the next several years.

Strategic Formulation is the process of deciding on new strategies, whereas strategic planning is the process of deciding how to implement the strategies.

A budget is a management plan, with the implicit assumption that positive steps will be taken by the budgeter-the manager who preparers the budget-to make actual events correspond to the plan. Budgeting process focuses on a single year, whereas strategic planning focuses on activities that extend over period of several years. Strategic planning precedes budgeting and provided the framework within the annual budget is developed. A budget is, in a sense, a one year slice of the organisation’s strategic plan, the budgeting process involves more than simply carving out a slice. Strategic plan is essentially structured by product lines or other programs while budgeting is structured by responsibility centre. A forecast is merely a prediction of what will most likely happen, carrying no implication that the forecaster will attempt to so shape events that the forecast will be realised.

Budget Characteristics:

- A budget estimates the profit potential of the business unit

- It is stated in monetary terms

- It generally covers a period of one year

- It is a management commitment

- The budget proposal is approved by higher authority

- After approved, the budget can be changed only under specified conditions

- Periodically, actual financial performance is compared to budget

Economic Value Added (EVA) vs ROI (Return On Investment)

The good of EVA (net profit – capital charge) – Appropriate for Profit Center – To measure efficiency. EVA is a dollar amount, rather than a ratio. It is found by subtracting a capital charge from the operating profit.

- All business units have the same profit objective for comparable investments. On the country, a business unit achieving 30% ROI will reluctant to expand unless they got 30% ROI or more.

- Decision to increase a centre’s ROI may decrease its overall profits

- Different interest rate can be used for different types of assets

- Has stronger positive correlation with changes in a company’s market value.

- Having more EVA means more profit more money to be distributed or retained. Also if we borrow money from bank, we gain more trust from banks. Also it will attract more investor, since the stock price will increase as well.

- Stated in monetary units

- It shows negative or positive value

The good of ROI (Operating Margin (NI/Sales) x Asset Turnover (Sales/Assets)) – Appropriate for Investment Center – To measure effectiveness. ROI is a ratio. The numerator is income, as reported on the income statement. The denominator is asset empaled

- It reflects how good the asset is employed to generate return

- Easy to measure and means absolute (>25% high, <5% low) than EVA

- No size effect. can be implemented in all profit center

- The competitor’s ROI data is available, for comparison

Balance Score Card measures the four following perspectives

- Financial (e.g., profit margins, ROA, cash flow)

- Customers (e.g., market share, customer satisfaction index)

- Internal Business (e.g., employee retention, cycle time reduction)

- Innovation and Learning (e.g., percentage of sales from new products)

Why we need non financial measures

- Financial may encourage short term actions that are not in the company interest

- BU may not undertake useful long-term actions to obtain short term profit

- Short term profit as the only objective can distort communication between BU manager and senior management. The BU manager tend to set profit target which easily meet.

- Tight financial control may motivate managers to manipulate data.

Implementing a performance measurement system steps:

- Define strategy

- Define measures of strategy

- Integrate measures into the management system

- Review measures and result frequently

Difficulties in implementing

- Poor correlation between financial and non financial measures

- Fixation of financial results

- Measures are not updated

- Measurement overload

- Difficulty in establishing trade-offs

Variance analysis compares the actual performance with the budget. Competent operating managers nevertheless adopt a continuous improvement or Kaizen. There are types of variances:

- Revenues variances > Selling price variance, Mix and volume variance, Mix variance, Volume variance

- Expense variances > Fixed cost, Variable cost,

Types of Responsibility centre

- Expense center are responsibility centres whose inputs are measured in monetary terms, but whose outputs are not. Ex. Manufacturing function and R&D function

- Profit Center. both revenue and expenses associated with generating this revenues are measured; the difference between them is profit. Ex. Businee unit

- Revenue Center, output is measured in monetary terms, but no formal attempt is made to related input (i.e., expense or cost) to output. The objective is to improve the market share. Ex. Marketing function

- Investment Center in which both profit and the investment (assets) used in carrying out that centre’s responsibility are measured. Ex. Business Unit

Expense Center

- Engineered Expense Center. Input can be measured in monetary terms – Output can be measured in physical terms – The optimum dollar amount of input required to produce one unit of output can be determined. Such unit perform repetitive tasks for which standard cost can be developed. Output multiplied by standard cost of each unit produced measures what the finished product should have cost. The difference between actual cost represents the efficiency of the expense centre being measured. But the quality has the risk, control are taken tightly. The engineered cost predominate.

- Discretionary Expense Center. Administrative and support units (e.g., accounting, legal, industrial relations, public relations, human resources). Optimal relationship between input and output cannot be established. Difference between budgeted and actual expense is no a measure of efficiency.

Profit Center

- The manager should have access to relevant information needed for making such a decision

- There should be some way to measure the effectiveness of the trade offs the manager has made.

The advantage of profit centers are listed below:

- Quality of decision may improve

- Speed of operating decision

- Relieved of day to day decision making

- Imagination and initiatives

- Excellent training ground

- Profit consciousness

- Profitability of the company’s individual components

- Improve competitive performance

Difficulties of profit centers

- Loss of controls

- Quality decision made at the unit level may be reduced

- Friction may increase over appropriate transfer price

- Competition with another

- Additional cost for task redundancies

Transfer Price

value placed on transfers of goods or services in transactions in which at least one of the two parties involved is a profit centre. Refer to amount used in accounting for any transfer of goods and services between responsibility centre.

Requirement to implement transfer price

- Systems should reflect the relevant information used in profit center

- Profit generated reflect the good of using trade off between cost and revenue

- Profit level should reflect the magnitude of contributed profit from each profit centre

Fundamental of Transfer price

- Transfer price should be about similar to market price

- For selling division, the transfer price would be revenue, and it will be counted as the profit for selling division

- For buying division, the transfer price is the cost. as a result, it can be sold anymore to gain a profit.

Objective of transfer price

- It should provide each business unit with the relevant information it needs to determine the optimum trade off between company costs and revenues.

- Induce goal congruent. business unit profit for company profit

- Help to measure economic performance

- Simple to understand and easy to administer

Pricing Method

- Market based transfer price. In the presence of competitive and stable external markets for the transferred product, many firms use the external market price as the transfer price. The weaknesses and the advantage are?

- Cost based transfer price. The transfer price is based on the production cost of the upstream division. A cost-based transfer price requires that the following criteria be specified: (a) actual cost or budgeted (standard) cost, (b) full cost or variable cost, (c) the amount of mark up, if any, to allow the upstream division to earn a profit on the transferred product.

- Competitive transfer price

- Negotiated transfer price. senior management does not specify the transfer price. rather, divisional managers negotiate a mutually-aggreeable price.

Compensation

Comprehensive Exam Questions

Prof Suwardjono

- How the auditor should confirm when there is no accounting standard in the country?

- Remember the definition of auditing that financial information in accordance with GAAP. P here is principle not standard.

- If there is no Generally Accepted Accounting Principles, then how?

- The accounting practice should confirm with fairness criteria

- What kind of fairness criteria?

Laurentius Suparwoto

- Why the financial statements should be audited?

- Remoteness

- Conflict of Interest

- Consequences

- …

- How to minimise the audit risk?

- Remember audit risk model AR: IR x CR x DR

Singgih Wijayana

- How the Management Control design should be applied in different business unit?

- Relating the responsibility centre and nature of the business unit.

- What kind of performance evaluation should be based other than EVA, ROI, and BSC?

- Target if it is in the business unit is assigned as the discretionary expense centre.

All

- How to measure manager performance?

- Why company does not need transfer pricing anymore?

- How to audit cash?

- What is alpha and beta risks?

- The employee most likely to be involved in a kickback scheme is the? account payable clerk

- Management commitment to competence should be reflected in? hiring assignments, training personnel, maintaining custody of purchased assets, reporting on expenditure cycle activities.

- Inherent risk for valuation and allocation assertion will be high in the personnel service cycle when?

- Which of the following is not among the specific auditing procedures the auditor performs to obtain additional audit evidence? reviewing evidence concerning litigation, claims and assessment.

- By the definition, subsequent event occur between?

- Pro forma data attached to the financial statements are only required with? a very material type 2 subsequent event

- Which the following events in a subsequent event period is an example of a type 1 subsequent event? settlement of warranties in excess of recorded amounts.

- Example of loss contingency?

- The client representation letter should include representations about all of the following except? major client policy changes

- Why GAAP prefer using historical cost?